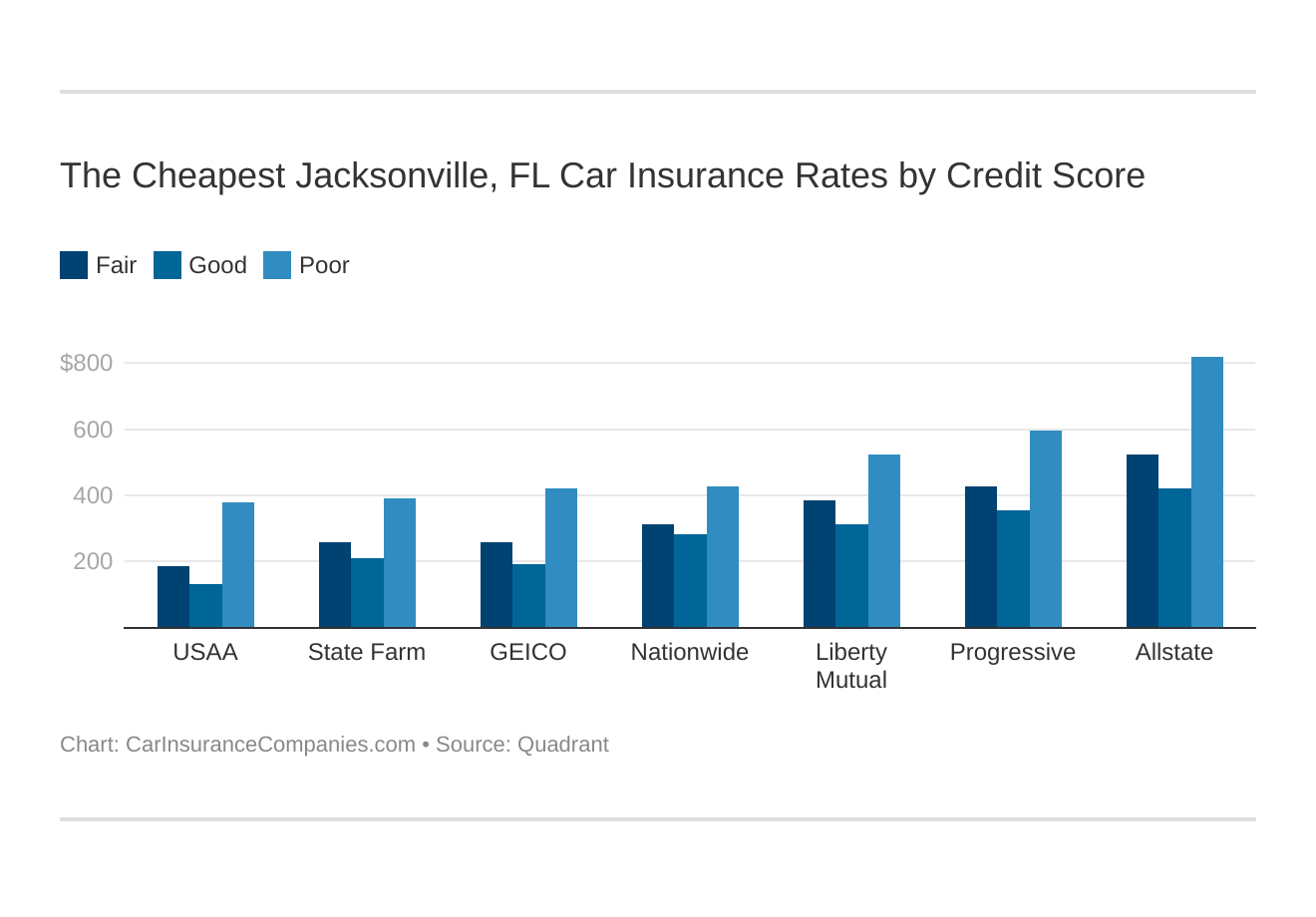

The typical annual price of vehicle insurance in Florida for a 40-year-old driver with a clean driving document acquiring a complete insurance coverage policy is $2,208. insurance companies. The state minimum automobile insurance policy coverage for the same 40-year-old driver would only cost approximately $1,123 per year. Pricing varies substantially with your driving account (credit score).

Cash, Nerd investigated typical insurance expenses in Florida based on numerous aspects to help you comprehend just how these factors impact the prices. Average Cost of Automobile Insurance in Florida: Summary, Money, Geek took a look at exactly how insurance policy prices in Florida modification with specific variables. Average Cost of Cars And Truck Insurance Policy in Florida: Complete Protection vs. The typical expense of full protection automobile insurance in Florida is $2,208 per year a substantial difference of $1,085.

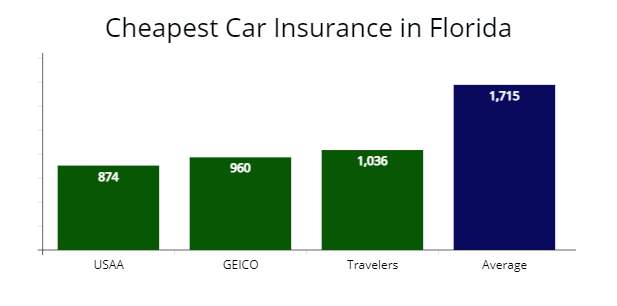

Bankrate's research study can aid you comprehend the typical auto insurance coverage rates in Florida along with the aspects that impact your auto insurance premium. Just how much is vehicle insurance in Florida? Florida drivers pay approximately$2,364 each year for full insurance coverage, which is 41 %more than the national yearly standard of$1,674. Nonetheless, your expense will rely on a number of score aspects, including where you live within the state and also what protection types as well as degrees you select. cheaper auto insurance. Florida vehicle insurance prices by business The very best automobile insurance provider in Florida each have their own one-of-a-kind underwriting criteria, insurance coverage offerings, discount rates and also plan attributes. To offer you a concept of what you might anticipate to pay for cars and truck insurance coverage in Florida, below are the average yearly costs for complete insurance coverage for a few of the largest insurance companies by market share in the state. You may additionally want to contrast coverage offerings, discounts, client solution ratings as well as economic stamina rankings when choosing an insurance provider. Price of living in Florida and also cars and truck insurance, When purchasing the very best cars and truck insurance policy prices in Florida, it is necessary to consider

your other expenses to ensure that you're considering your total living costs. If you are unsure the length of time an additional charge could remain on your policy, you can call your insurance representative or supplier to learn. Florida vehicle insurance coverage prices by automobile kind, One of the largest aspects in identifying your auto insurance coverage prices is the make and design of car that you drive. The sort of lorry you drive can additionally impact just how much insurance coverage and also what kinds of coverage you choose. Often asked concerns, What is the ideal vehicle insurance provider in Florida? Every chauffeur brings a special collection of situations to their vehicle insurance policy search, so the most effective auto insurance policy business will be various for everyone (perks).

When you know what you want from an insurance firm, you can obtain numerous quotes to help you locate the coverage you require at a competitive cost. What is the ordinary price of minimum protection in Florida? Having an auto plan with the state-required minimum insurance coverage limitations in Florida sets you back approximately$1,101 each year, almost double the national average of$565 per year. 4% without insurance driver price, among the highest possible in the U.S. according to the Triple-I, you may wish to take into consideration including this insurance coverage on your policy. You might intend to think about greater responsibility limits or full insurance coverage to much better secure yourself in case of a mishap. Full protection, that includes collision insurance coverage and extensive protection, is not called for by legislation however will likely be required if you have a finance or lease. These are sample prices and need to just be made use of for relative purposes.: Rates were calculated by reviewing our base account with the ages 18-60 (base: 40 years)used. Relying on age, drivers might be an occupant or house owner. For teens, prices were established by including a 16 -or 17-year-old teenager to a 40-year-old couple's plan. Prices were determined by evaluating our base account with the complying with events applied: tidy document( base ), at-fault accident, single speeding ticket, single drunk driving conviction as well as lapse in coverage. or Canada, PIP covers you and also relatives who stay in your residence. In this situation, you have to be driving your own vehicle. Individuals apart from you or your relatives are not covered.(back to cover)Residential or commercial property damage responsibility insurance pays for damage that you, or members of your household, cause to an additional person's residential or commercial property while driving. 1, 2007, you should have$ 100,000 worth of protection each and$300,000 well worth of insurance coverage per accident. You additionally need to have a minimum of $50,000 in home damages insurance coverage - insurance affordable. BIL spends for severe as well as long-term injury or fatality to others when your cars and truck is included in an accident and also the driver of your automobile is located to be responsible somewhat. It additionally covers people who drive your automobile with your consent. With this sort of policy, the insurer likewise will certainly pay for your.

legal defense if you are filed a claim against.(back to cover )Although it is not called for by regulation, many chauffeurs get other kinds of insurance policy protection in enhancement to the required PIP and also building damage responsibility insurance. Collision insurance coverage pays for fixings to your car if it rams one more car, crashes right into an item or hands over. It pays despite who triggers the crash. Accident insurance policy does not cover injuries to people or damages to the residential or commercial property of others. Detailed insurance coverage pays for losses from incidents other than an accident. Without insurance vehicle driver (UM )insurance policy pays if you, your guests or member of the family are struck by somebody who is "at fault"and does not have insurance coverage, or has inadequate obligation insurance to cover the complete damages endured by you. This applies whether you are riding in your cars and truck, riding in somebody else's cars and truck or are struck by a car as a pedestrian. If you have collision protection or building damages liability, you may be covered for damages to rental autos driven by you, relying on the conditions of your policy. You additionally might be instantly covered by your charge card firm if you utilized the card to rent the vehicle.(back to cover )Vehicle service warranties are excellent just for a specified length of time and also make sure just the repair work or replacement of items specified in the agreement. Service service warranties are agreements that are controlled by the Division of Financial Providers. automobile. Whether a service guarantee

deserves the cash will certainly depend on exactly how the warranty suits your needs. Be certain to request for the very same protection from each so your contrasts will be precise. A quote is an estimate of your premium it is not a strong rate or an agreement. Nevertheless, it is against the law for a representative to purposefully price quote you a low premium just to obtain your organization. False or incorrect details could trigger the business to terminate your plan or refuse to pay a case. Constantly get a copy of the authorized application. Make sure to obtain a binder from the agent as soon as you authorize the application. A binder is your temporary proof of insurance policy up until an official plan is released.

Make checks or money orders payable to the insurer never to the agent or the firm. You ought to obtain your policy no behind 60 days after the reliable date. If you do not obtain your plan, contact your agent. Quickly report any kind of modifications influencing your policy to your agent. This required protection will certainly not cover you if you are harmed in a bike crash. Some insurance policy firms may supply PIP and also medical payment insurance coverage for motorbikes as added insurance coverage that can be purchased. In order to run or ride on a motorbike without headgear, you have to be over 21 years old

How Florida Car Insurance - Usaa can Save You Time, Stress, and Money.

and also have an insurance plan offering at the very least$ 10,000 in clinical advantages for injuries endured as a result of a collision. Keep in mind these ideas: Review your plan. Make sure you understand your plan. If you have any type of concerns, call your agent or the Division of Financial Services toll-free at 800-342-2762. The selection of insurance provider as well as agent is your own. You do not need to buy vehicle insurance policy from the dealer who offered you the automobile or the lending organization financing your vehicle. Insurance Coverage by State Florida Automobile Insurance Florida is a no-fault state, implying that crash victims must seek healing for damages from their insurers, also if the other driver was liable for the mishap. Bringing a suit versus the at-fault vehicle driver is tough, otherwise impossible under the majority of scenarios - vehicle. Florida, like other no-fault states, has higher insurance coverage premiums than states without no-fault insurance and also is amongst the much more pricey states in the country when it concerns car insurance coverage premiums - cheaper. Florida Automobile Insurance coverage Details No-fault insurance coverage means all drivers must buy minimum Individual Injury Security(PIP)insurance coverage as well as Residential property Damages Liability(PDL)insurance policy.

Icon-cars and truck with a guard and check mark- Injury Protection insurance coverage in Florida. The General Insurance policy vehicle guard icon-Rapid, free quotes for quick protection Injury Security(PIP)Personal Injury Security Insurance covers the vehicle driver and member of the family, as well as anybody in the car at the time of the mishap who does not have a registered lorry as well as PIP insurance coverage. That same percent likewise composes the number of foreign residents, among the largest in the nation. Almost 30 percent of children speak a language various other than English in the home. Florida Automobile Insurance Policy & Mishap Facts Florida has the uncertain difference of the state with the largest variety of uninsured vehicle drivers. Place It's usual to pay more for industrial car insurance coverage in a bigger city like Miami than a smaller city like Ft Meyers. Bear in mind, locations that experience even more cases are normally priced more than various other locations. Areas vulnerable to weather-related events such as cyclones and floods are also variables. Understanding why the costs are so high in the very first location can help you reduce your insurance policy sets you back so you can enjoy living in such a great state (insurance company). Why is Florida Cars And Truck Insurance Coverage

So Expensive? Because Florida requires fairly thorough vehicle insurance, lots of people question concerning the expense of that type of protection. Understanding what these factors are can assist you recognize why insurance coverage is so expensive there. Population, Florida has an unbelievably high population for its dimension, which makes it a really dense state.

Although Florida is just 22nd in dimension, it is 3rd in populace in the United States. It only drops behind California and New York City when it concerns the variety of people residing in the state. Florida hosts 128 million visitors every year who are trying to see the area's various attractions. When individuals are driving in an unknown area, they are a lot moreprone to crashes and possible vehicle damage when driving. Insurance business comprehend this and also take it right into account when they are setting their rates in certain areas. cheap insurance. This is since when you remain in a mishap with a without insurance vehicle driver, the company will certainly spend for problems under uninsured driver insurance coverage. affordable car insurance. This places the company at a much greater risk and costs them more money than they would certainly pay if both chauffeurs were guaranteed. In Florida, 26. 7 percent of vehicle drivers do not have insurance policy. The high price of insurance causes a greater number of uninsured chauffeurs, which exacerbates the problem. Weather condition, While Florida is known for having great deals of cozy sunlight, it is also known for cyclones as well as various other extreme climate. This raises the chance that vehicles will certainly endure damage whether they are on the road or otherwise. This is specifically real when people live near the ocean, rivers, or other areas that are prone to flooding. Personal Injury Protection Demand, In the state of Florida, all drivers are required to have Individual Injury Security insurance. This makes it a no-fault state. This detailed coverage is not called for in many various other states and it increases the total cost of coverage for all Florida motorists. This protection need raises costs for drivers by 20 percent as well as is one of the main reasons insurance policy rates are so high in the state (auto). Risky Chauffeurs, Whenever an area has a population of risky chauffeurs, insurance premiums are going to be greater. In Florida, there are a number of demographics that car insurance provider think about to be high risk. It must be kept in mind that demographics like this are starting to come to be less of an aspect in car insurance coverage costs as time goes on.